Deadline is February 22 to appeal property tax assessment!

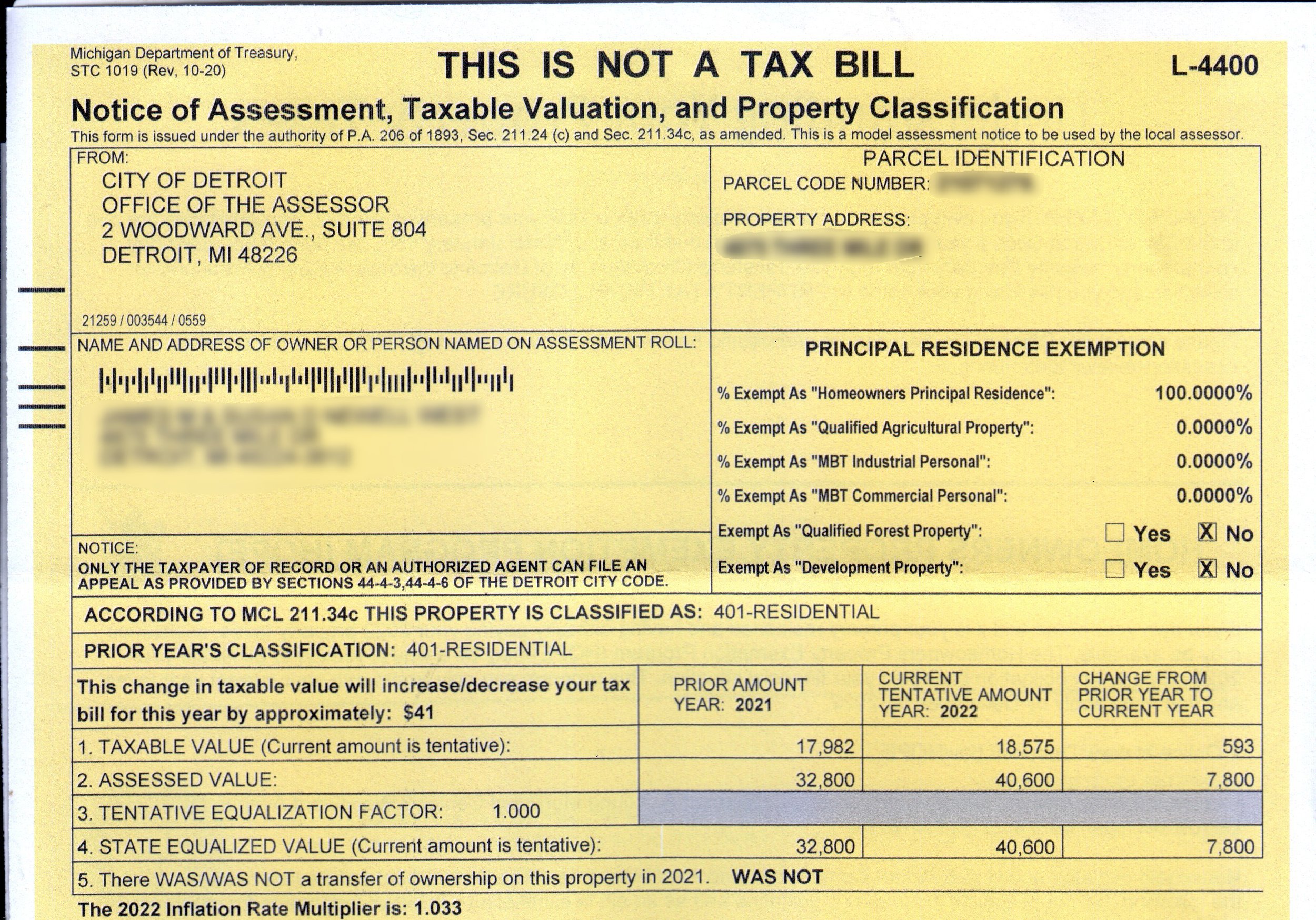

Property Tax Assessment sample. Image courtesy of the City of Detroit

By now you should have received notice of your property tax assessment for this year. This is not a bill - just a statement of how the county has assessed the value of your property. Many factors should be taken into account when assessing your property, including the physical condition of the surrounding neighborhood and property values in your area. If you think your property has been overassessed, you have until Tuesday, February 22 to appeal it. And you don’t have to do it alone. There are more resources than ever to help you navigate the process.

There’s even help available in our own neighborhood. Jackie Grant, President of Friends of the Alger Theater, has been doing property tax counseling for a number of years now and has helped many MorningSide residents keep their homes. She has virtual office hours by appointment on Tuesdays and Thursdays from 1 to 5 p.m. For those who don’t have internet access, inperson appointments can be arranged. To make an appointment, contact Jackie at (313) 720-3904 or email her at president@algertheater.org.

Check out this article from Bridge Detroit for more information on property tax assessments and other avenues for help.

Also, property tax foreclosures, which have been on hold during the pandemic, are set to begin again this year. If you or anyone you know is behind on property taxes, follow this link to another Bridge Detroit article to see what help is available to you.